cumulative preferred stockholders have the right to receive

A corporation might omit its dividends because it is suffering operating. In the fourth year he will receive 40 4 years multiplied by 10 4 Retained Earnings.

Common Stock Vs Preferred Stock 365 Financial Analyst

Urusula has invested in preferred stocks of a firm.

. Companies also use preferred stocks to transfer corporate ownership to another company. Pnet net issuing price. Both are discretionary and have expiration dates.

Preferred stock shareholders will have claim to assets over common stock shareholders in the case of company liquidation. Preferred stock also has first right to dividends. That depends on whether the preferred.

If a company does decide to skip a dividend it may or may not have to pay that dividend back later. Unlike cumulative preferred stock noncumulative preferred stock has a right to a dividend that expires if the dividend is not declared. A dividend on preferred stock is the amount paid to preferred stockholders as a return for the use of their money.

Holders of cumulative preferred shares are entitled to receive dividends retroactively for any dividends that were not paid in prior periods whereas non-cumulative preferred shares do not carry. As the prospectus says she will get a preferred dividend of 8 of the par value of shares. A perpetual preferred stock is a type of preferred stock that has no maturity date.

Common shareholders have no guarantee that they will receive dividends. The issuers of perpetual. For example if a company owns 20 or more of another distributing companys stock they dont have to pay taxes on the first 65 of income received from dividends.

Preferred stock dividends may be stated as a fixed amount such as 5 or as a percentage of the stated price of the preferred stock. Warrants and options are similar in that the two contractual financial instruments allow the holder special rights to buy securities. However if the earnings of a company increase the company may choose to raise the dividends that it pays on common stock.

For one thing companies get a tax write-off on the dividend income of preferred stocks. Preferential stockholders receive a dividend as compensation for their investment. Urusual has bought 1000 preferred stocks.

Bob did not receive payment for three years. The par value of each share is 100. Stock preferred as to dividends means that the preferred stockholders receive a specified dividend per share before common stockholders receive any dividends.

Preferred stock is an equity security that has the properties of both an equity and debt instrument and is higher ranking than common stock. Meanwhile the preferred stockholders plug along still getting the same fixed rate. Preferred stock holders receive a fixed guaranteed dividend payment.

Assuming that the cash E and G receive is taxable under section 301 F will be deemed under section 305c to have received a distribution under section 305b2 of 1666 shares of stock to which section 301 applies and H will be deemed under section 305c to have received a distribution under section 305b2 of 3886 shares of stock to. The basic two things to calculate the dividend are given. Relative Cumulative Total Shareholder Return as of 4222022.

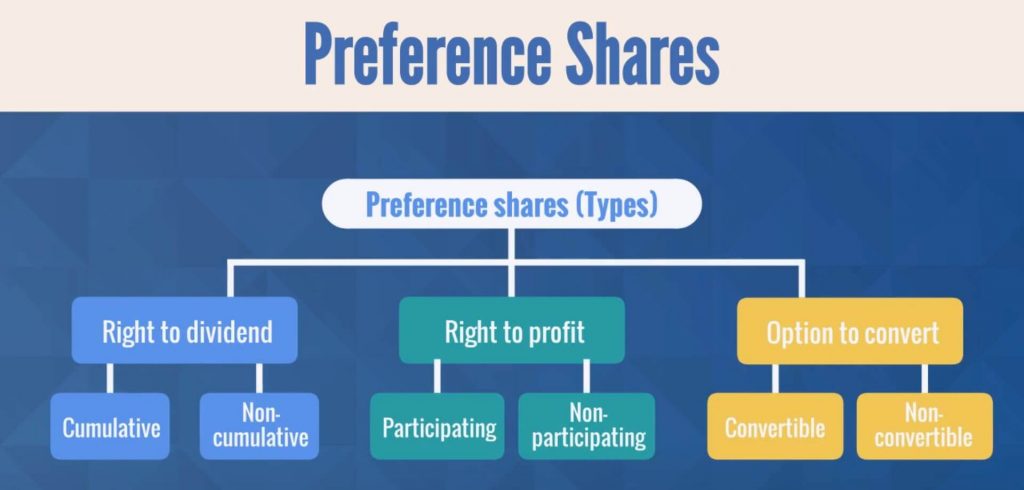

Preferred dividends can be cumulative or non-cumulative. Cumulative preferred stocks may postpone the dividend but not skip it entirely the company must pay the dividend at a later date. And Board would have known that it was not the right time to engage in a large-scale acquisition much less financing the deal with.

In finance a warrant is a security that entitles the holder to buy or sell stock typically the stock of the issuing company at a fixed price called the exercise price. For example a 10 dividend on 80 preferred stock is an 8 dividend. Lets say a companys preferred stock pays a dividend of.

Perpetual Preferred Stock. For no-par preferred stock the dividend is a specific dollar amount. Preferred stock holders can have a broad range of voting rights ranging from none to having control over the eventual disposition of the entity.

They differ mainly in that warrants are. The preferred investors receive a predetermined payout per share before the common stockholders receive any dividends. Rps cost of preferred stock.

For example Company XYZ declares 10 cumulative dividends Dividends Dividends refer to the portion of business earnings paid to the shareholders as gratitude for investing in the companys equity. Dps preferred dividends. How much dividend will she get every year.

Noncumulative preferred stocks may skip paying the dividends. Noncumulative If a preferred stock is designated as cumulative preferred stock its holders must receive any dividends that had been omitted on the preferred stock in addition to its current year dividend before common stockholders are paid any dividends.

What Is Preferred Stock Is It Right For My Portfolio Nerdwallet

![]()

Streaming Realtime Quotes Pink Sheets Level 2 Otcbb Level 2 Denial Optimism Euphoria

Looking For A Best It Firm Digital Transformation App Development Companies Business Performance

Iso 9001 Management Tips Productivity Measurement Uncertainty

Preference Shares And Its Different Types Sag Rta Preferences Exams Funny Wix Website Design

Iso 9001 Management Tips Productivity Measurement Uncertainty

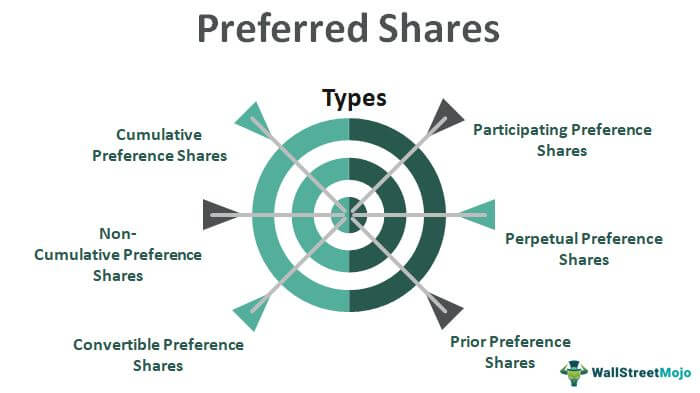

Preferred Shares Meaning Examples Top 6 Types

Streaming Realtime Quotes Pink Sheets Level 2 Otcbb Level 2 Denial Optimism Euphoria

Common And Preferred Stock Principlesofaccounting Com

Difference Between Cumulative And Non Cumulative Preferred Stocks With Table Ask Any Difference

Cumulative Preferred Stock Definition

Participating Vs Non Participating Preferred Stock Alcor Fund

Types Of Preference Shares Accounting Principles Learn Accounting Accounting And Finance

What Is A Preferred Stock And How Does It Work Ramseysolutions Com

Cumulative Preference Shares Assignment Point

Cumulative Preferred Stock Definition Business Example Advantages

Advantages And Disadvantages Of Equipment Leasing Accounting And Finance Economics Lessons Financial Management

How To Calculate The Price Of Preferred Stock For A Startup Abstractops

/book-with-page-about-preferred-stock--trading-concept--814447584-db8f837c330d4d8e9974c345d342867d.jpg)